Represented D.C. United in Agreement to Host Soccer Match with World Class FC Bayern Munich

Represented Major League Soccer team D.C. United in its agreement to host a friendly match with world class FC Bayern Munich of the German Bundesliga. This match marks the first meeting between the two teams and the second international friendly between D.C. United and a top division European team at Audi Field.

Resources

Equity Investment in Golf Equipment and Apparel Company

Represented longtime client in its equity investment in a golf equipment and apparel company, and in its related fundraising arrangements and co-investments from several high-profile investors.

Negotiated separation agreement for senior executive of professional sports team

Represented senior executive in the negotiation of a separation agreement from a professional sports team.

Represented D.C. United in Establishment of Retail Sportsbook at Audi Field

Represented D.C. United in connection with the establishment of a state-of-the-art retail sportsbook at Audi Field operated by FanDuel. FanDuel is the first sportsbook to set up shop at a Major League Soccer stadium, bringing the soccer league into line with the NFL, NBA and NHL. The FanDuel sportsbook stretches over 2,700 square feet and features three wagering stations, 47 HD televisions, two large video walls, 18 self-service kiosks, and an uninterrupted view of the field for fans to enjoy D.C. United matches and other sporting events.

Resources

Represented Legends in Minority Investment and Strategic Partnership with TeamTrak Cycling

Represented Legends in its strategic partnership and minority investment in TeamTrak Cycling League, an entity of World Cycling Limited, to support the launch and growth of the startup indoor cycling league. TeamTrak is an innovative, proprietary format of indoor velodrome racing. The partnership spans revenue-generating sponsorship sales and omnichannel merchandise services as well as a minority investment in TeamTrak.

Legends will manage a data-driven approach for TeamTrak, leveraging data and analytics to provide fan insights and asset valuation to drive sponsorship sales and overall revenue-generating opportunities for the league. Legends will also provide broadcast and media rights partnership support for TeamTrak. With the growth of TeamTrak, the league will have access to Legends’ intelligence-fueled 360-degree service solutions.

Resources

Professional Golf Tour – Advised on Spectrum of Matters

Counseled LIV Golf, a professional golf tour whose mission is to modernize the game of professional golf through expanded opportunities for players and fans, on a spectrum of issues including general employment matters, ticketing issues, broadcast and media rights, liability issues and facial recognition technology issues.

Sale of Controlling Ownership Stake in United Soccer League Championship Club

Herrick represented D.C. United in its agreement with Attain Sports & Entertainment to sell a controlling ownership stake in United Soccer League (USL) Championship club Loudoun United FC (LUFC).

The founding of Loudoun United FC as the first professional soccer team in northern Virginia was one of several steps of investment into the sport and the local northern Virginia community taken by the D.C. United ownership group in recent years. Accompanying the establishment of the club was the development of a 5,000-seat stadium—Segra Field—in Leesburg, Virginia, which serves as the home for Loudoun United in addition to professional rugby, concerts, local sporting events, and more.

“Our decision to launch a team and build a stadium in the region showcases our commitment to the growth of the sport in the northern Virginia community and its ability to foster community, create economic growth, and provide entertainment for residents and visitors in the region,” said Jason Levien, CEO and Co-Chairman of D.C. United.

The investment in the USL Championship club by Attain Sports & Entertainment will add to the company’s growing portfolio of professional sports assets.

Resources

Represented Formula 1’s Las Vegas Grand Prix in Sponsorship and Partnership Agreements

Represented Las Vegas Grand Prix, Inc., a subsidiary of Formula 1 owner Liberty Media Corporation and the promotor of the Formula 1 Las Vegas Grand Prix, in its sponsorship agreement and partnership with Aristocrat Technologies, Inc., a leading slot machine and casino game manufacturer.

Resources

Legends Hospitality – Master Management Services Agreement with 3ICE

Represented Legends in connection with a Master Management Services Agreement with 3ICE, an organizer and operator of a three-on-three professional hockey league. This strategic partnership will support and accelerate the growth of the new independent North American hockey. In addition to managing several lines of revenue generating operations for 3ICE, Legends will make a minority investment in the league.

Resources

Represent the Pac-12 Conference in Insurance Dispute

Represent the Pac-12 Conference in an insurance dispute in connection with a charge brought by the National College Players Association claiming that the Pac-12 Conference and the USC are violating the National Labor Relations Act by refusing to classify student athletes as employees.

Represented Legends in connection with a Master Management Service Agreement

Represented Legends in connection with a Master Management Services Agreement with Glytch, Inc., a provider of professional esports stadiums with location-based entertainment and live broadcasting.

Resources

Represented Legends in Transactions with Premium Omni-Channel Food Tech Platform

Represented Legends in its investment in, and business partnership with, a premium omni-channel food tech platform that operates food halls in metropolitan areas and licenses various culinary brands, in negotiating and drafting an investment agreement, food hall management agreements, licensing and development agreements and various other operational agreements and side letters.

Advised on Potential Ownership Issues for Expansion Team of Professional Soccer Team

Represented potential owner of expansion team of professional soccer team in North America. Provided advice regarding the application process and provided analysis of franchise agreement and potential conflict issues.

Represented Milwaukee Bucks Co-owner, Marc Lasry, in the Sale of Stake in the Team

Represented Milwaukee Bucks co-owner, Marc Lasry, in the sale of his 25 percent stake in the team to Cleveland Brown owners Jimmy and Dee Haslam. According to ESPN, the transaction struck at a $3.5 billion valuation was the second highest valuation ever paid for an NBA team and the third highest valuation for any American professional sports team. It was a tremendously successful conclusion to Mr. Lasry’s tenure as an owner and steward of the championship Bucks.

Represented Legends in Potential Joint Venture with Provider of a No-Code Platform

Represented Legends in connection with potential joint venture with a provider of a no-code platform that provides a non-fungible token (aka NFT) wallet, access to multiple blockchains, tokenization and utility-driven smart contracts to empower marketers and brands to build web3 customer loyalty communities.

Advised Online Betting Platform on Advance Deposit Wagering (ADW)

Advised a leading internet horse racing account wagering operator as to the legality of conducting advance deposit wagering (“ADW”) activities in the 50 states and D.C. ADW is a form of pari-mutuel wagering on horse racing whereby a person establishes an account with an ADW operator and subsequently communicates (typically via the internet) instructions concerning the wagering of the funds in such person’s account to the ADW operator. Advice based upon comprehensive review of applicable horse racing statutes and regulations and select federal gambling laws.

Represented Internet Account Wagering Operator on Technology Joint Venture

Represented a leading internet horse racing account wagering operator in formation of joint venture with major European gambling software engineering firm to develop technology and software that facilitates the operation of computerized advance deposit wagering (“ADW”) for horse racing. ADW is a form of pari-mutuel wagering on horse racing whereby a person establishes an account with an ADW operator and subsequently communicates (typically via the internet) instructions concerning the wagering of funds in such person’s account to the ADW operator.

Represented Avenue Capital Group in PGA Tour Investment

Represented Avenue Sports Fund, an affiliate of Avenue Capital Group, respecting its investment in Strategic Sports Group (SSG), a consortium of sports franchise owners and investors, in support of SSG’s $3 billion investment in PGA Tour Enterprises, a new commercial venture between the PGA Tour, SSG and PGA Tour players.

Assisted LIV Golf in Negotiating Agreements for Creation of Promotional Content

Assisted LIV Golf, Inc. in negotiating a key master services agreement and associate statements of work with a digital marketing services provider, for the creation of a wide range of promotional content, including film and video content production, for the 2024 LIV professional golf season and beyond.

University of Nevada, Las Vegas – $1.9 Billion Las Vegas Stadium Development

Representing the University of Nevada, Las Vegas, in negotiating a joint-use agreement with the NFL’s Las Vegas Raiders related to the development of the $1.9 billion Las Vegas Stadium.

MLS Soccer Agency – Establishment of US Platform

Represented a major league soccer agency in the establishment of its US platform.

U.S. Commercial Bank – $50 Million Senior Secured Revolving Line of Credit

Represented a U.S. commercial bank, as a sole lender, in a $50 million senior secured revolving credit facility to owners of an MLB franchise. The proceeds are to be used for working capital purposes.

NFL Franchise – Class Action

Represented a national football league team in a class action.

Legends Hospitality – Notre Dame

Represented Legends Hospitality in its partnership with Notre Dame and JMI Sports to oversee Notre Dame’s sales, marketing, hospitality, media rights and branding services nationally.

Regional Sports Network – $660 Million Financing

Represented a leading regional sports network in amending and restating its senior secured credit facility into a $600 million term loan facility and a $60 million delay draw facility. The proceeds will be used to refinance existing indebtedness, redeem existing senior subordinated notes, and for working capital purposes.

New York Islanders – Hockey with a Heart

Represented the New York Islanders in connection with the formation and organization of Hockey with a Heart, a non-profit entity formed to promote the Islanders' numerous charitable endeavors.

Regional Sports Network – $200 Million Note Refinance

Represented a leading regional sports network in the redemption of senior subordinated notes in the principal amount of $250 million and in the issuance of new senior subordinated notes in the principal amount of $200 million.

Regional Sports Network – Corporate Restructuring

Represented a leading regional sports network in a restructuring of its ownership structure through the formation of a new Delaware limited liability company.

New York Islanders – Charity Raffles

Advised the New York Islanders in connection with conducting 50/50 raffles in New York and Connecticut.

Venture Capital Investment

Representing a premier hospitality management company in a high-tech venture capital investment to enhance the stadium experience.

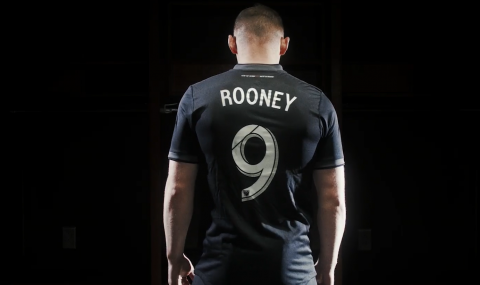

D.C. United – Wayne Rooney Transfer Agreement

Represented Major League Soccer's D.C. United in its permanent transfer agreement with English Premier League superstar Wayne Rooney. Rooney, who was most recently with Everton F.C., scored 208 goals in 16 seasons in the English Premier League — the second most in league history.

UFC – Mayweather v. McGregor Bout

Represented Ultimate Fighting Championship (UFC), as lead counsel, in the August 2017 Floyd Mayweather, Jr. v. Conor McGregor bout at the T-Mobile Arena in Las Vegas.

D.C. United – Audi Field Financing and Naming Rights

Represented Major League Soccer’s D.C. United in the construction financing and naming rights transactions for the club’s new state-of-the-art soccer-specific stadium in Southwest D.C., Audi Field.

Chicago Cubs – CBS Radio Broadcast Rights Agreement

Represented the Chicago Cubs in a multi-year radio license with CBS Radio to broadcast Cubs games on WBBM Newsradio 780AM. The radio license is part of a sports and entertainment partnership that also includes several promotional initiatives across all seven of CBS Radio's local Chicago radio stations and digital and social media platforms. Additionally, the partnership will create and produce live music events at or near Wrigley Field.

New York Racing Association – NYRA Bets National Betting Platform

Represented New York Racing Association in a joint venture formed to conduct the NYRA Bets national advance deposit wagering business.

Envy Gaming – Proposed Sale of eSports Business

Represented Envy Gaming in the proposed sale of a minority equity interest in the organization to a private equity firm consortium and an NBA franchise ownership group.

Capture the League – Corporate Matters

Represented Capture the League, LLC, a multi-game eSports organization, in corporate matters related to preparation of non-player employment and confidentiality agreements, independent contractor agreements, master service agreements and player trades.

Legends Hospitality – Investment by New Mountain Capital

Represented Legends Hospitality, the sports and entertainment joint venture controlled by the New York Yankees and Dallas Cowboys, in a strategic partnership and investment in the company by New Mountain Capital.

Lelands – Jim Brown’s NFL Championship Ring

Represented Lelands in litigation filed in New York federal court by former National Football League player Jim Brown regarding the recovery of a 1964 NFL championship ring alleged to have been stolen.

New York Yankees – $1.5 Billion Stadium Financing

Represented the New York Yankees in the issuance of $1.5 billion in municipal tax-free and taxable bonds by the New York City Industrial Development Agency, which financed the lease and construction of the new Yankee Stadium. We drafted and negotiated the lease agreement for the new stadium, as well as ancillary real estate agreements pertaining to parking lots and garages; construction, demolition and insurance, and public transportation. We were also integrally involved in navigating the Yankees through the lengthy federal, state and local governmental permit and approval process.

New York Racing Association – Not-for-Profit Foundation

Represented New York Racing Association in the formation of a not-for-profit foundation.

Tampa Bay Lightning – Amalie Arena Naming Rights

Represented the National Hockey League's Tampa Bay Lightning in its arena naming rights agreement with Amalie Oil Co.

Sports Memorabilia Company – Major League Baseball Trophy Dispute

Represented a sports memorabilia company in an authentication dispute related to Major League Baseball trophies.

Professional Baseball Team – Breach of Contract Litigation

Represented a professional baseball team in a purported breach of contract action by an office equipment leasing company seeking to hold our client liable for financial losses suffered by one of the plaintiff’s independent dealers.

Professional Baseball Team – Summary Judgment in Breach of Contract Dispute

Represented a professional baseball team in securing summary judgment in a federal court litigation arising from the breach of a multi-year advertising agreement with a mobile security firm. The court awarded our client $1.7 million, plus interest and late fees, as well as attorneys’ fees and costs.

Professional Baseball Team – Ticket Purchase Agreement Dispute

Represented a professional baseball team in resolving a dispute over a ticket purchase agreement.

Professional Baseball Team – Default Judgment in Advertising Agreement Litigation

Represented a professional baseball team in securing default judgment in litigation arising from a stadium vendor’s breach of an advertising agreement.

eSports Organizations – Corporate Counsel

Provided general corporate counseling for various eSports organizations including start-up team Infinity Core, Team EnVyUS and FlyQuest.

Legends Hospitality – International Stadia Group Acquisition

Represented Legends Hospitality in the acquisition of International Stadia Group, a London-based sports and entertainment company. The acquisition will extend Legend’s global capabilities and allow for growth opportunities in the EAME regions.

Asset Management Co. – Acquisition of Israeli Basketball Team

Represented an asset management company in the proposed acquisition of an interest in a premier professional basketball team located in Jerusalem. The team has won several titles recently, including the EuroCup and the Israeli League championship.