Real Property Income and Expense (RPIE) Statement Submission Cure Period

September 1, 2021All income producing properties within the City of New York were required to have a Real Property Income and Expense (RPIE) Statement electronically submitted to the Department of Finance no later than June 1, 2021. The submitted information is used by the assessor to determine the assessment for a subject property in the following tax year. The 2022/2023 tax year utilizes the 2020/2021 financials.

Even if your property meets one of the various exclusions to not submit financial information, you must still submit a response indicating the reason for the property’s exclusion. The Department of Finance recently sent a correspondence to property owners regarding a thirty day cure period from the dispatch date printed within in which non-filers may make a late submission and avoid the imposition of costly penalties. If you are unsure of whether your property is considered a non-filer, review the links below.

| RPIE-2020 Nonfilers (Real Property) List |

Adobe PDF | MS Excel |

| Manhattan | Download | Download |

| Bronx | Download | Download |

| Brooklyn | Download | Download |

| Queens | Download | Download |

| Staten Island | Download | Download |

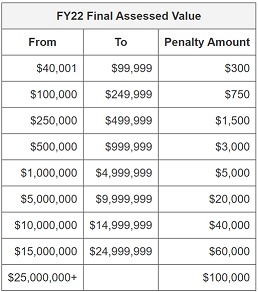

Non-filing penalties are determined by the amount of the property’s assessed value as per the table below.

Owners who do not file a claim of exclusion but are required to do so would incur a $100 penalty. Failure to file an RPIE for three consecutive years may result in a penalty equal to 5% of the property’s actual assessed value. Furthermore many exemption and abatement programs including the Industrial Commercial Abatement Program (ICAP) require the annual filing of the RPIE or risk the suspension or revocation of benefits.

Please consult an accounting professional for assistance with completing the RPIE. Herrick, Feinstein LLP cannot not provide counseling on RPIE submissions.

Additional information regarding the RPIE application may be found here: Real Property Income and Expense (RPIE) Statements (nyc.gov).

For more information on this issue or other Real Estate or Real Estate Tax Incentive Programs, please contact:

Brett J. Gottlieb at +1 212 592 1455 or [email protected]

© 2021 Herrick, Feinstein LLP. This alert is provided by Herrick, Feinstein LLP to keep its clients and other interested parties informed of current legal developments that may affect or otherwise be of interest to them. The information is not intended as legal advice or legal opinion and should not be construed as such.