Manhattan Commercial Revitalization Program (“M-CORE”)

February 1, 2024The New York City Economic Development Corporation ("NYCEDC") and New York City Industrial Development Agency ("NYCIDA") has opened a second application round for the Manhattan Commercial Revitalization Program, or "M-CORE", which seeks to lower commercial tenant vacancy rates by offering discretionary tax incentives to upgrade aging office spaces in Manhattan below 59th Street.

Specifically, the program offers the following:

- Real property tax exemption and stabilization;

- Partial mortgage recording tax exemption; and

- Sales and use tax exemption on construction materials and other eligible materials.

With respect to real property taxes in particular, taxes for land and existing improvements may be stabilized and building taxes for new improvements may be abated for a period of up to 20 years (with a phase out over the final four years of such period).

To be eligible, in addition to being located in Manhattan south of 59th Street (but excluding the Hudson Yards Financing Area and Penn Station Area General Project Plan), a building needs to be at least least 100,000 gross square feet in size, reduced from the prior requirement of 250,000 gross square feet, and needs to have been built prior to 2000. Furthermore, there is a minimum capital investment requirement of 75 percent of the project location’s current assessed value per the NYC Department of Finance for the most recent available fiscal year.

Program acceptance is considered to be competitive. NYCIDA may award benefits for up to 10 million square feet of office space. NYCIDA's criteria includes:

- Project scope and budget with a focus on transformative projects

- Tenant attraction plan

- Project readiness

- Compliance with local laws, including Local Law 97 emission-reduction targets

NYCIDA will accept applications for the program through April 15, 2024.

Existing Alternative to M-Core

The Industrial Commercial Abatement Program ("ICAP") provides a real property tax abatement for upwards of 25 years (upwards of 12 years in Manhattan south of 59th Street) throughout the five boroughs of New York City with an exclusion in Manhattan between 59th Street and 96th Street. Unlike M-Core, ICAP is as-of-right subject to limitations as set forth the Real Property Tax Law.

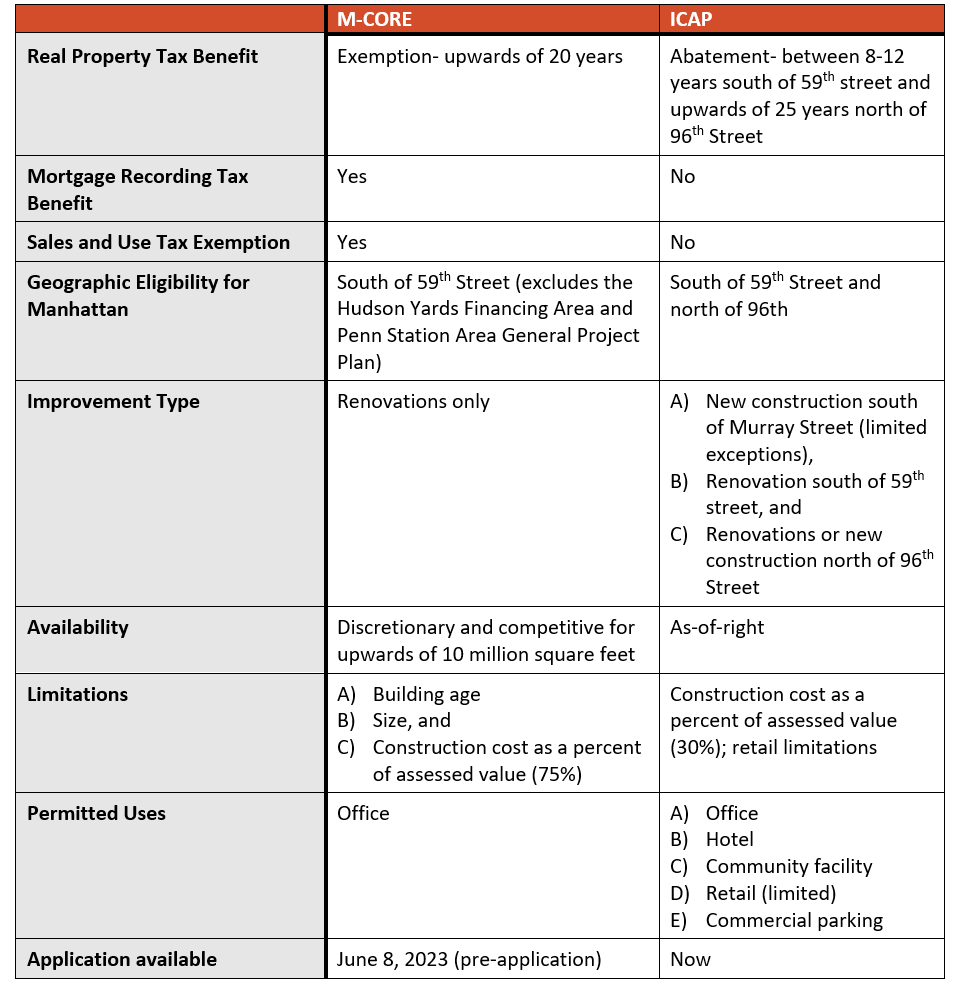

Comparison of M-CORE and ICAP in Manhattan

Herrick's Real Estate Group is continuing to monitor for updates related to M-CORE and is available to discuss the pre-application process or any related questions as well as to discuss ICAP.

For more information on real estate matters, please contact:

Brett J. Gottlieb at 212 592 1455 or [email protected]

Patrick J. O'Sullivan, Jr. at 212 592 1503 or [email protected]

© 2023 Herrick, Feinstein LLP. This alert is provided by Herrick, Feinstein LLP to keep its clients and other interested parties informed of current legal developments that may affect or otherwise be of interest to them. The information is not intended as legal advice or legal opinion and should not be construed as such.